The Reserve Bank of India (RBI) has once again revised its guidelines for financial institutions, emphasizing the urgent need for stronger payment system security. On the same day these new regulations were announced, over 300 Indian banks fell victim to sophisticated cyber-attacks, highlighting the critical importance of robust security measures.

These attacks demonstrate the severe consequences of cyber threats, from financial losses to data breaches and eroded customer trust. In response, the RBI's stringent guidelines focus on proactive measures such as regular penetration testing, secure software development, and comprehensive user awareness programs—essential strategies to protect against evolving threats.

P.I.V.O.T Security aligns with these RBI guidelines, offering specialized services like penetration testing, software assurance, and tailored training programs. These efforts not only ensure regulatory compliance but also help institutions effectively manage and mitigate cyber risks.

As the importance of these cybersecurity services becomes clear, the next step is to delve into how these services, particularly penetration testing and secure development practices, form the foundation of a strong defense.

The RBI guidelines stress the need for strong cybersecurity services to protect payment systems from threats. Penetration testing and regular security testing are key parts of this. These tests help identify vulnerabilities, ensure the integrity of software, and provide assurance that systems are secure against potential attacks. By addressing these areas, financial institutions can prevent data breaches, financial losses, and maintain customer trust. Security services play a vital role in these areas:

Secure Development Practices: Building security into every step of software development is crucial. P.I.V.O.T Security's expertise in secure software development helps institutions reduce risks right from the start.

Comprehensive Security Testing: Annual security tests, including checking source code and performing penetration testing, are required by the RBI. P.I.V.O.T Security offers detailed penetration testing to find weaknesses and test the resilience of applications against cyber threats. These tests mimic real attacks to assess the effectiveness of current security measures and identify any gaps.

Building a security-aware culture is crucial for the safety of financial institutions. The RBI guidelines stress the need to educate both employees and customers about cyber threats and how to stay safe. It's not just about teaching; it's about creating a mindset that can spot and deal with security issues quickly. When everyone in the organization knows what to watch out for and how to respond, it significantly reduces the risk of cyber-attacks.

Employee Training and Awareness

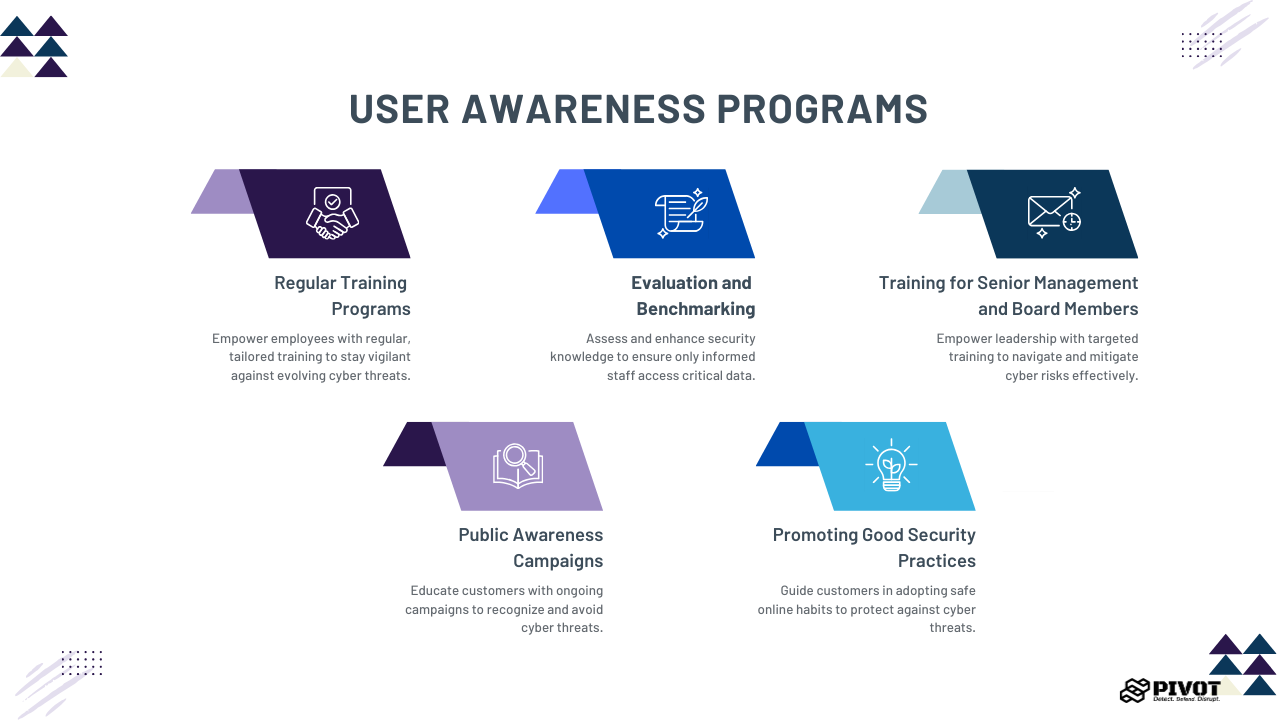

Regular Training Programs: Regular training is important for employees and vendors who handle information. Custom training programs should cover the latest cyber threats, best security practices, and the need to stay alert. These programs ensure that staff members know how to identify and respond to potential threats.

Phish-E: Our specialized training tool plays a crucial role in this process. It helps keep employees and vendors alert by providing regular, realistic phishing simulations and training. It ensures everyone is ready to spot and stop potential threats.

Evaluation and Benchmarking: It's important to check how well employees understand security. Services to measure and compare employee knowledge can help. Those who don’t meet the required levels can be limited in accessing sensitive information, ensuring only informed staff handle critical data.

Training for Senior Management and Board Members: Special training for senior leaders and board members ensures they understand cyber risks and how to manage them. Focused training for these leaders emphasizes the importance of cybersecurity throughout the organization.

Public Awareness Campaigns: Financial institutions should run regular campaigns to teach customers about cyber threats and how to avoid fraud. These campaigns help make customers more aware of security issues.

Promoting Good Security Practices: Educating customers on safe online habits can help prevent cyber threats. Providing advice and resources on how to recognize phishing attempts, create strong passwords, and use multi-factor authentication is essential.

Effective governance and oversight are crucial for maintaining strong cybersecurity measures. This means having clear policies, defined roles, and proactive strategies to manage cyber risks. The RBI guidelines highlight the need for solid governance structures and readiness to handle cyber risks. It’s about ensuring that all levels of the organization are prepared to respond to threats quickly and effectively, minimizing damage and ensuring the continuity of secure operations.

Being prepared means having a plan in place to quickly detect, contain, respond to, and recover from cyber threats. This involves creating a Cyber Crisis Management Plan (CCMP) approved by the Board. The CCMP should outline the steps to take during different types of cyber incidents, ensuring the organization can recover quickly from attacks.

Regularly checking for risks and keeping an eye on the organization’s cybersecurity status is vital. This means constantly evaluating the security setup to find and fix vulnerabilities. A designated executive, such as a Chief Information Security Officer (CISO), should oversee these activities to ensure they are thorough and effective.

Organizations need clear policies that define how to manage and reduce cyber risks. These policies should cover various aspects of cybersecurity, including access controls, data protection, incident response, and compliance with regulatory requirements. Regular updates and reviews of these policies keep them effective against evolving cyber threats.

Board members and senior management need to understand cyber risks and their potential impact. Regular training sessions and briefings on the latest cyber threats, regulatory changes, and best practices in cybersecurity help leaders make informed decisions and provide effective oversight.

To further enhance cyber resilience, financial institutions must implement baseline security measures as recommended by the RBI guidelines. These measures provide a solid foundation for securing payment systems against a wide range of cyber threats:

Patch and Change Management: It's essential to have a documented policy for applying security patches and managing changes. This includes identifying and implementing patches promptly to protect against known vulnerabilities. Testing patches and changes in non-production environments before deployment ensures they do not compromise the integrity of the IT setup.

Incident Response Mechanisms: A swift and effective response to cyber incidents is critical. Institutions need a clear incident response plan that includes prompt notification to senior management and regulatory authorities. Detailed analysis of incidents, including forensic analysis, when necessary, helps prevent the recurrence of similar events and strengthens overall security.

Business Continuity Planning (BCP): Developing comprehensive plans for rapid recovery from cyber incidents is vital. These plans should cover different threat scenarios and outline steps to resume critical operations quickly. Regular drills and tests ensure alignment with Recovery Time Objectives (RTO) and Recovery Point Objectives (RPO), helping institutions maintain operational continuity during cyber crises.

Access Controls: Implementing strict access controls is crucial for protecting sensitive information. This includes defining who can access what data and systems, and regularly reviewing and updating these permissions. Multi-factor authentication (MFA) should be used to add an extra layer of security.

Data Protection: Ensuring the confidentiality, integrity, and availability of data is a core aspect of cybersecurity. This includes encrypting data in transit and at rest and implementing measures to prevent data leaks and unauthorized access. Regular audits and monitoring help maintain data security.

Network Security: Protecting the network from external threats involves setting up firewalls, intrusion detection systems, and regular network scans. Network segmentation can also help limit the spread of cyber threats within the organization. Continuous monitoring and updating of network security measures are necessary to adapt to evolving threats.